|

eBay's online payment division and the global leader in online payments, PayPal, has added a new withdrawal feature for its Philippine and Indonesian members, allowing them to conveniently withdraw funds from their PayPal accounts to their local bank accounts.

Philippine and Indonesian Bank Account Withdrawals

How does it work?

How to add a bank account?

In just a few easy steps, you can add your Philippine or Indonesian bank account to your PayPal account in order to conveniently withdraw your money.

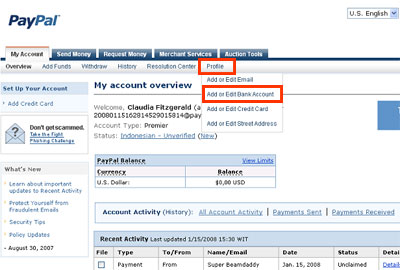

Step 1: Log into your PayPal account |

||

|

|

|

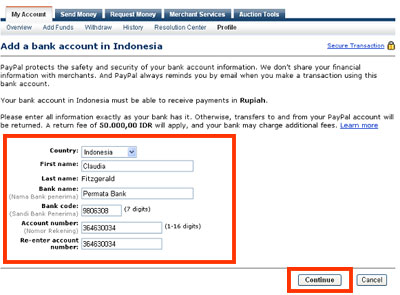

Step 2: Add your bank details |

||

|

|

|

|

||

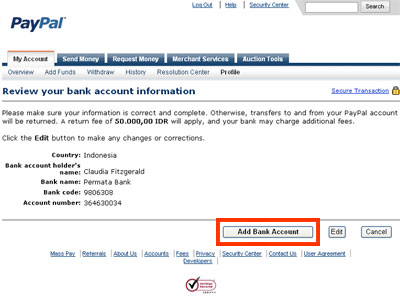

Step 3: Review your bank account information |

||

|

||

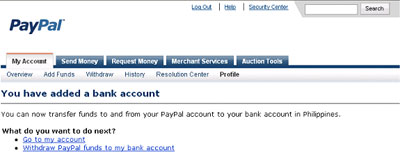

Step 4: Confirmation |

||

|

||

How do I withdraw the money?

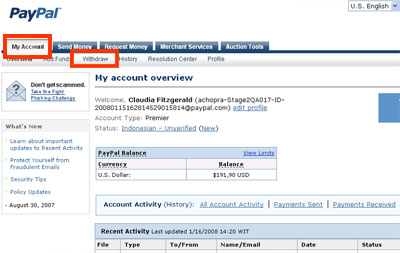

Step 1: Log into your PayPal account |

||

|

||

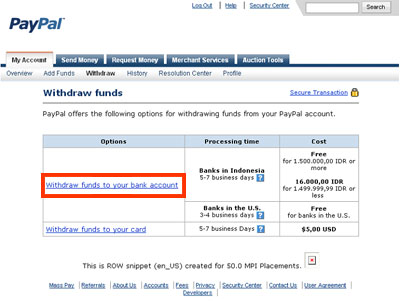

Step 2: Select the 'Withdraw funds to your bank account' option |

||

|

||

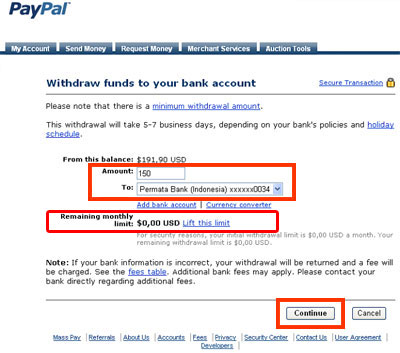

Step 3: Select the bank account and amount to withdraw |

||

|

||

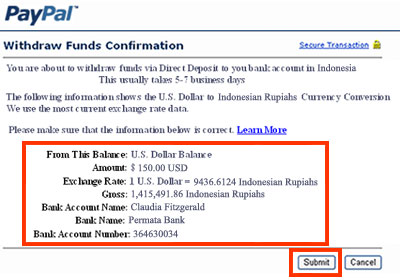

Step 4: Confirm the transfer |

||

|

||

Which bank can I use to withdraw my money?

All local banks can be used to withdraw the funds.

How long does it take for funds to reach my bank account?

It typically takes 5-7 business days. However, depending on your bank’s policies, it may take longer.

Is there a minimum withdrawal amount?

Yes, there is a minimum withdrawal limit depending upon the currency which you want to withdraw. For the different limits, please refer to the table below. However, non-verified PayPal members will not be permitted to make withdrawals of any amount. Learn

more about verification

Are there any requirements that I must fulfill before I can withdraw my funds?

You will need to add a bank account and also become a verified PayPal member.

Learn how to become a verified PayPal member now.

Can I still withdraw funds to a US bank account?

Yes, the functionality to withdraw your PayPal balance to a US bank account is still available.

Can I still withdraw funds to a Visa debit, credit, or prepaid card?

Yes, the functionality to withdraw your PayPal balance to a Visa debit card, credit card, or prepaid card is still available.

Learn more.

Can I withdraw US Dollars to a US Dollar denominated Philippine or Indonesian bank account?

No. At this time, PayPal only supports withdrawal to Peso or Rupiah bank accounts located in the Philippines or Indonesia. However, you can withdraw funds in US Dollars, if you have a United States bank account. Add a United States bank account to your PayPal account now.

What currency will be transferred from my PayPal account to my local bank account?

Regardless of the foreign currency (USD, EUR, AUD, etc.) you are withdrawing from your PayPal account, the funds will be converted to your local currency.

For example, if you are in the Philippines, your withdrawal will be converted into Pesos and transferred to your local bank account. If you are in Indonesia, your withdrawal will be converted into Rupiahs and transferred to your local bank account.

For Philippine users, withdrawals of PHP 7,000 or more are free. For withdrawal amounts less than PHP 7,000 there will be a fee of PHP 50.

For Indonesian users, withdrawals of IDR 1.5 million or more are free. For withdrawal amounts of less than IDR 1.5 million, there will be a fee of IDR 16,000.

Foreign exchange fees may also apply. Check our schedule of fees for details.

Please note that some banks charge their customers a fee for electronic funds transfers. PayPal can make no assurances that you will not be charged by your bank. Please ask your bank whether it charges for electronic fund transfers before you initiate a withdrawal.